Intraday Calls

Serving Since 2012

Equity, Future, Commodity & Option Calls

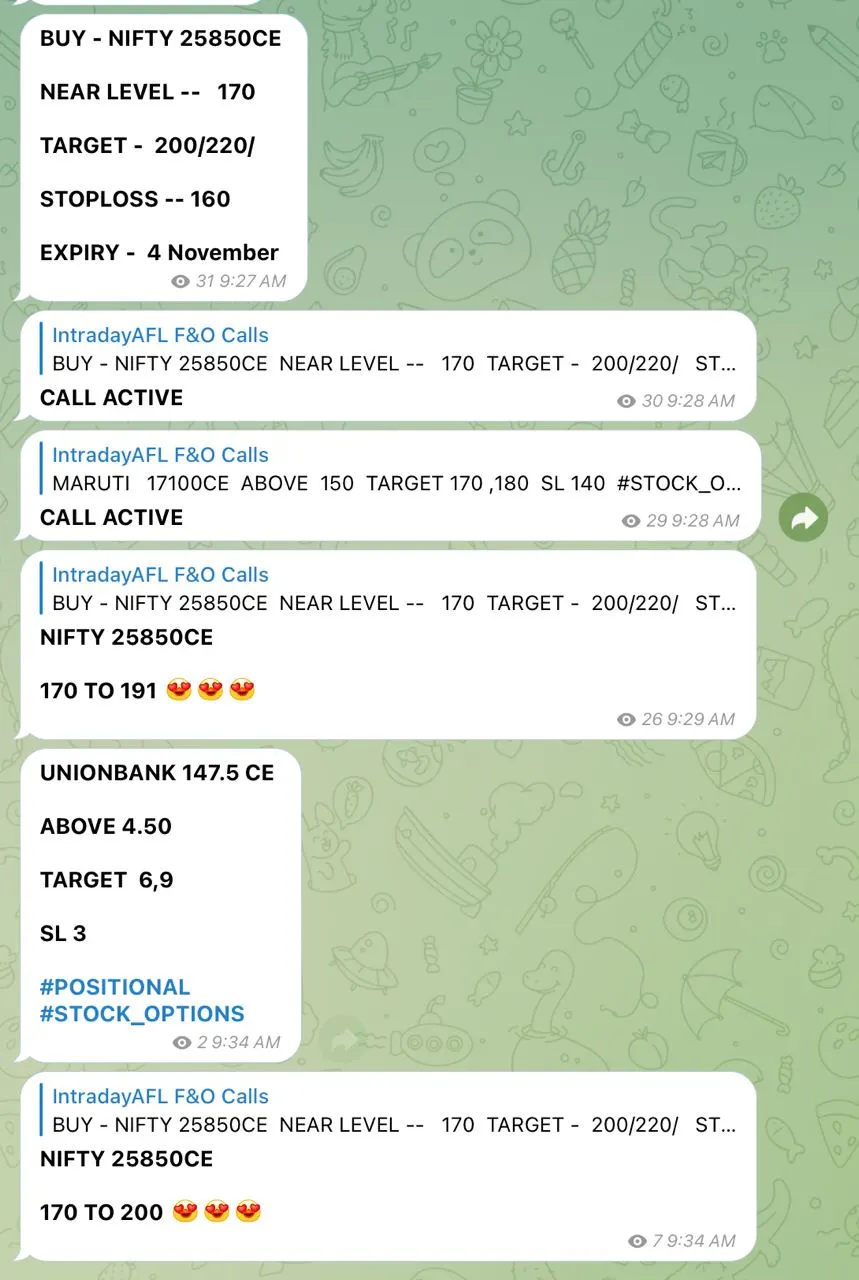

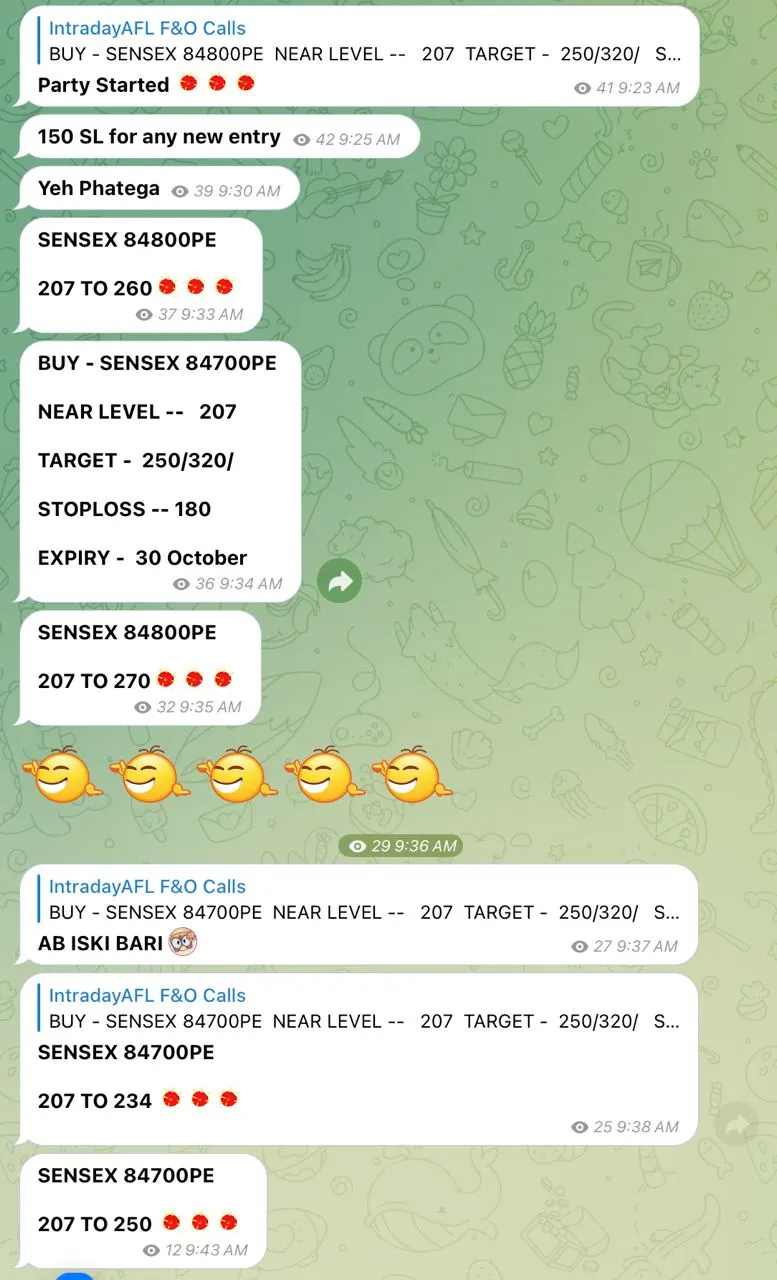

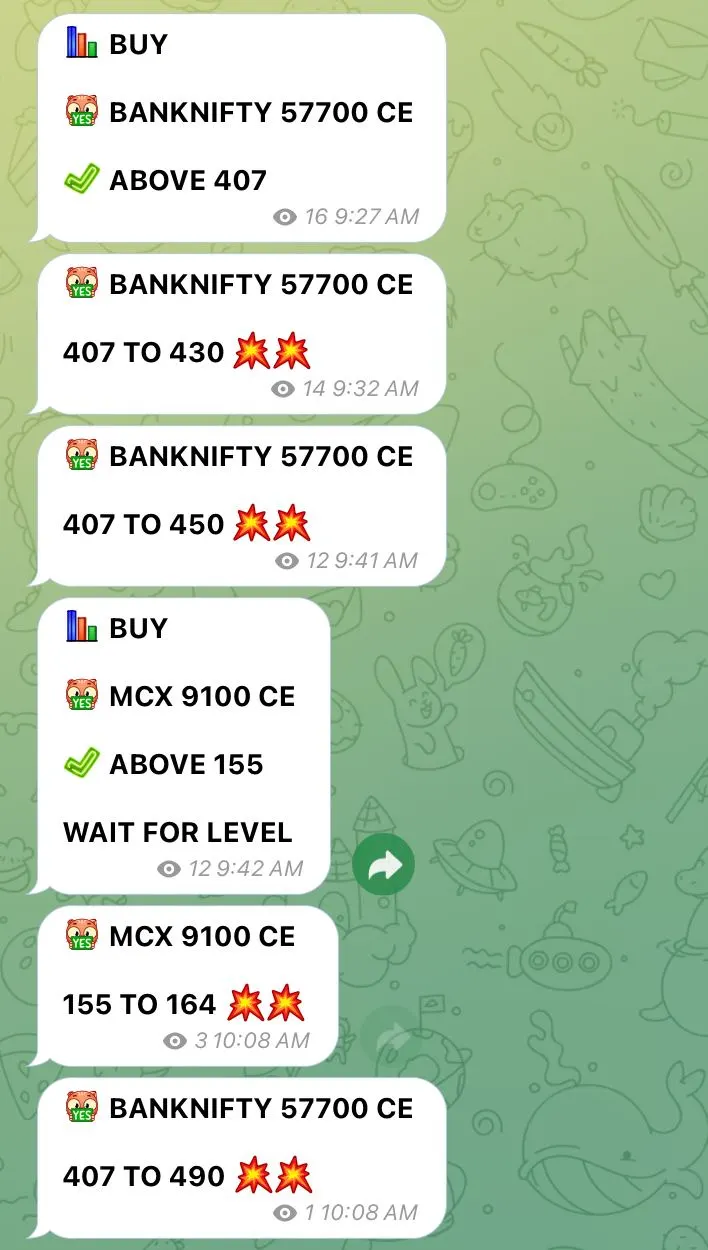

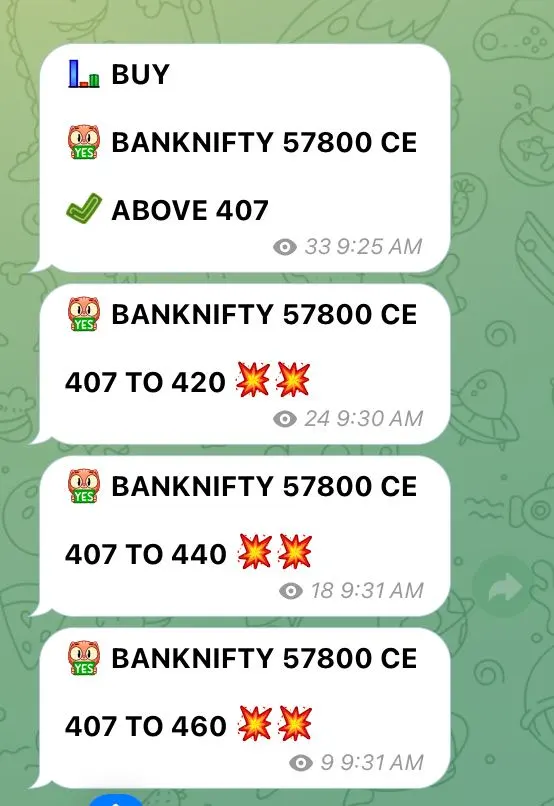

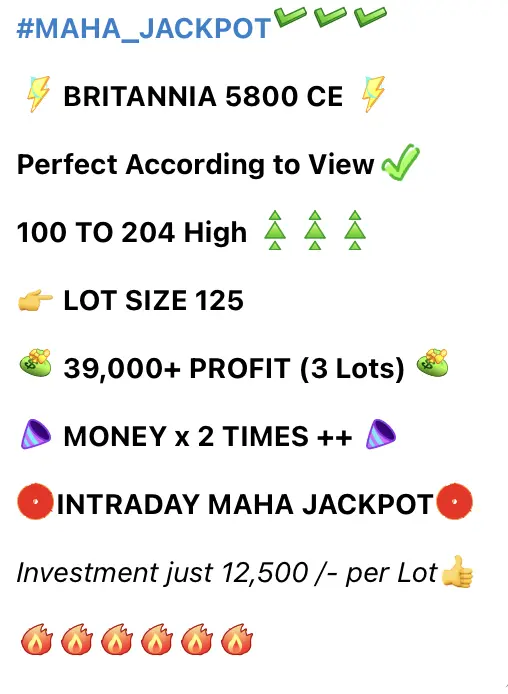

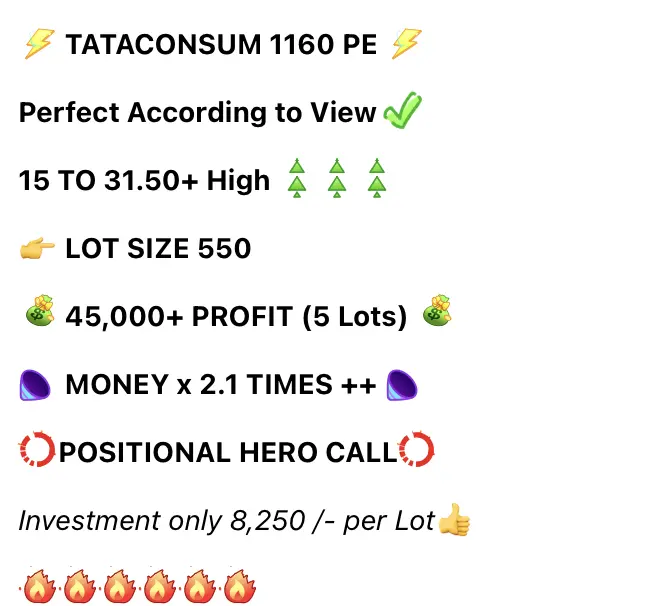

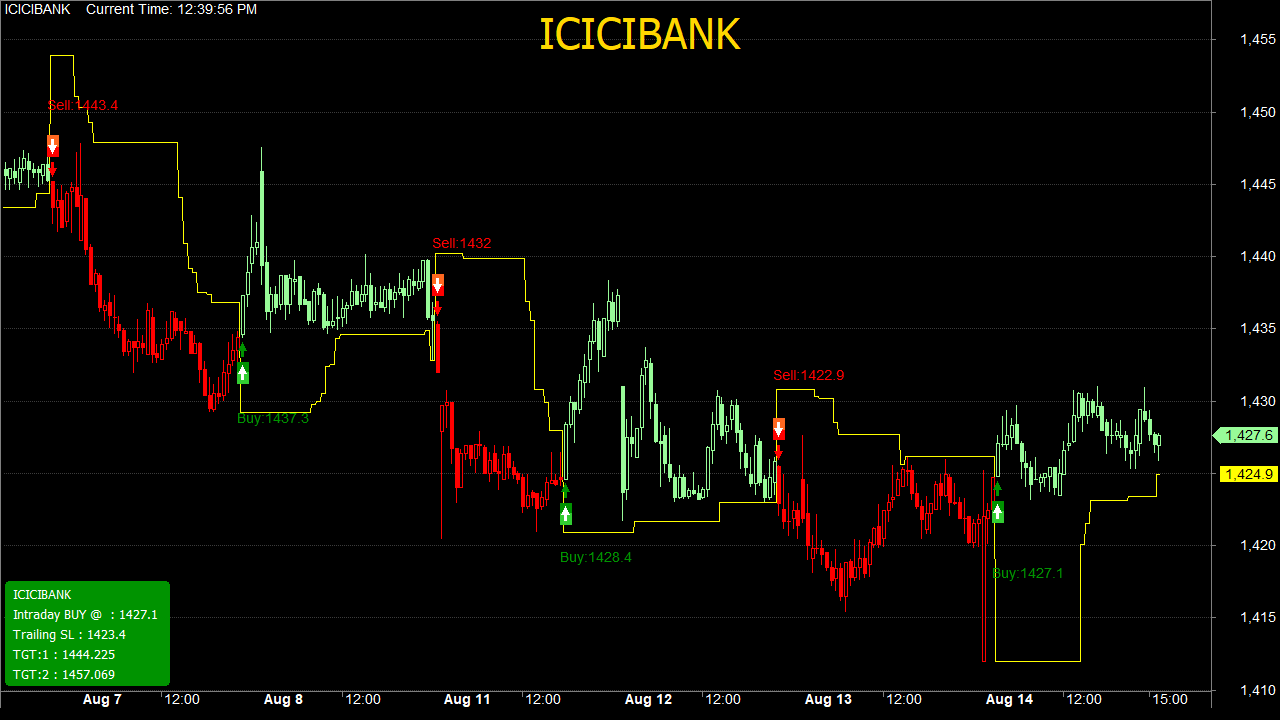

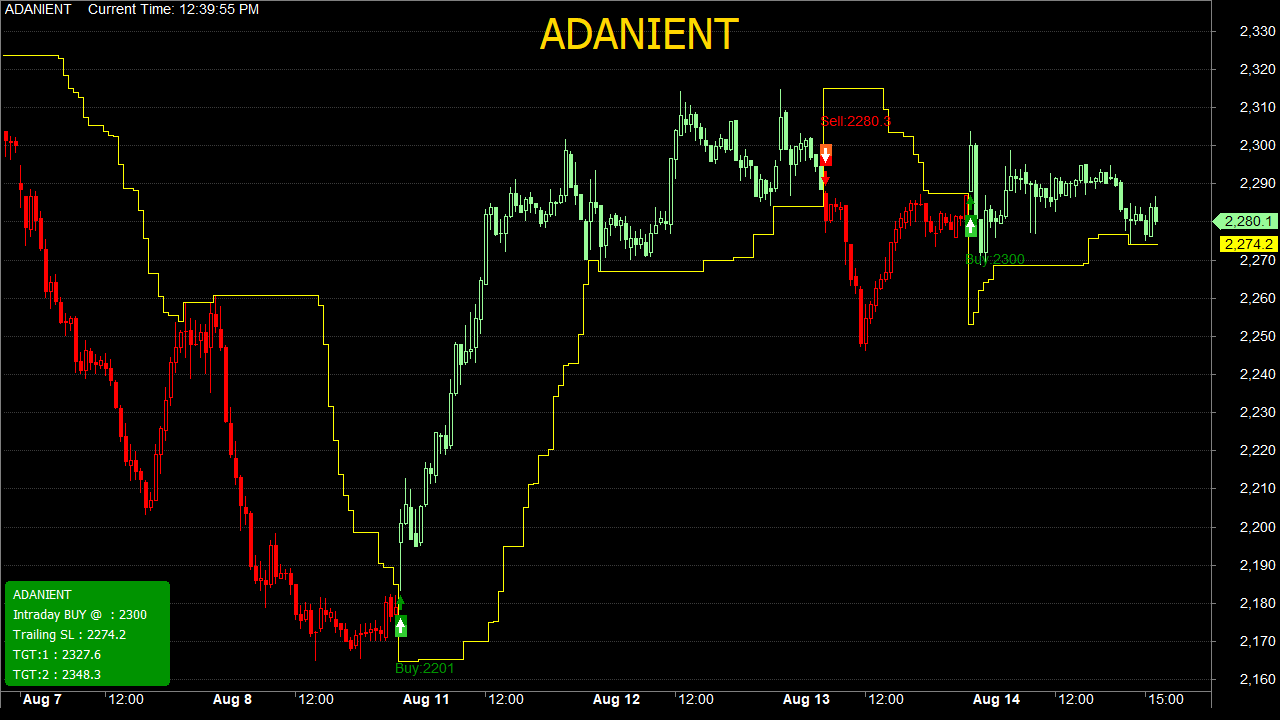

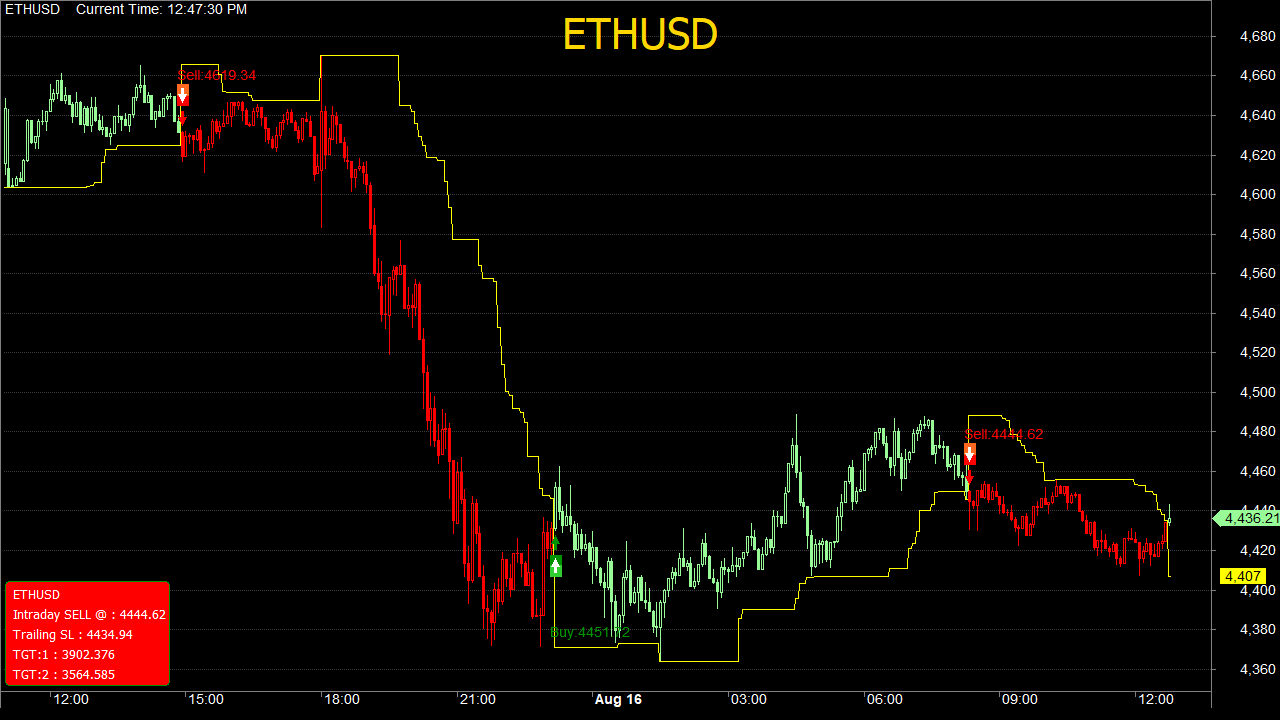

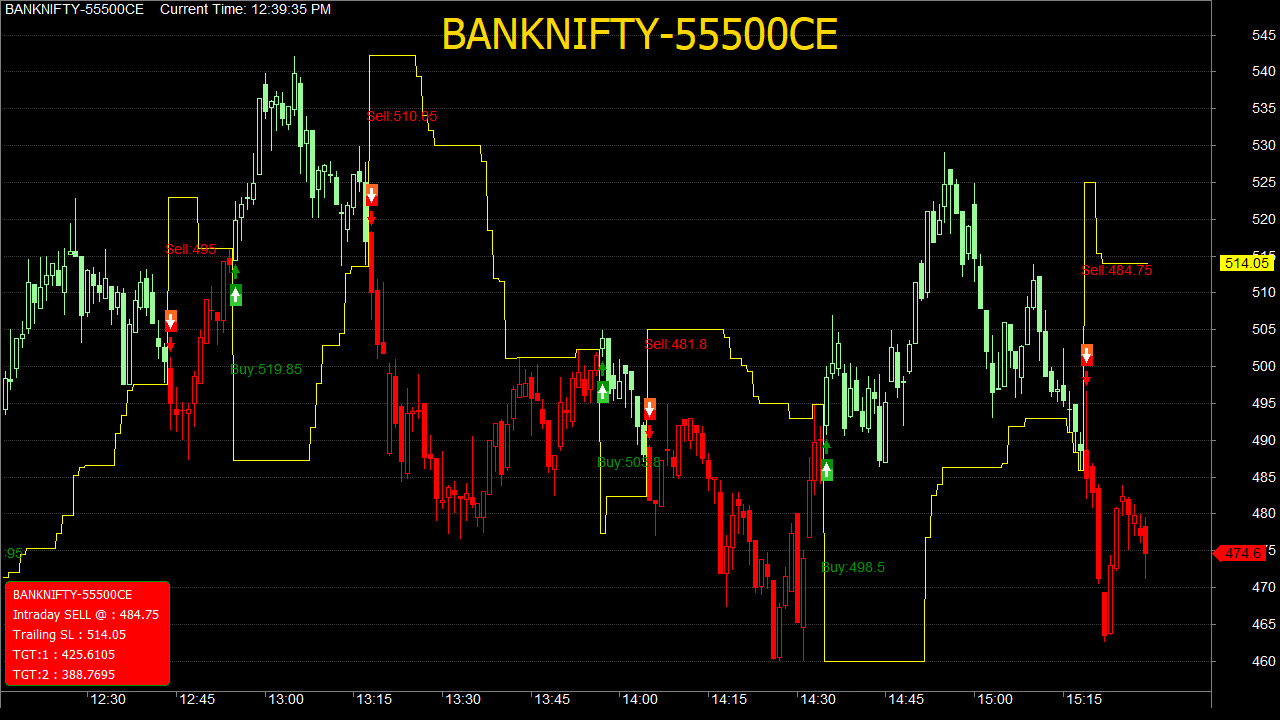

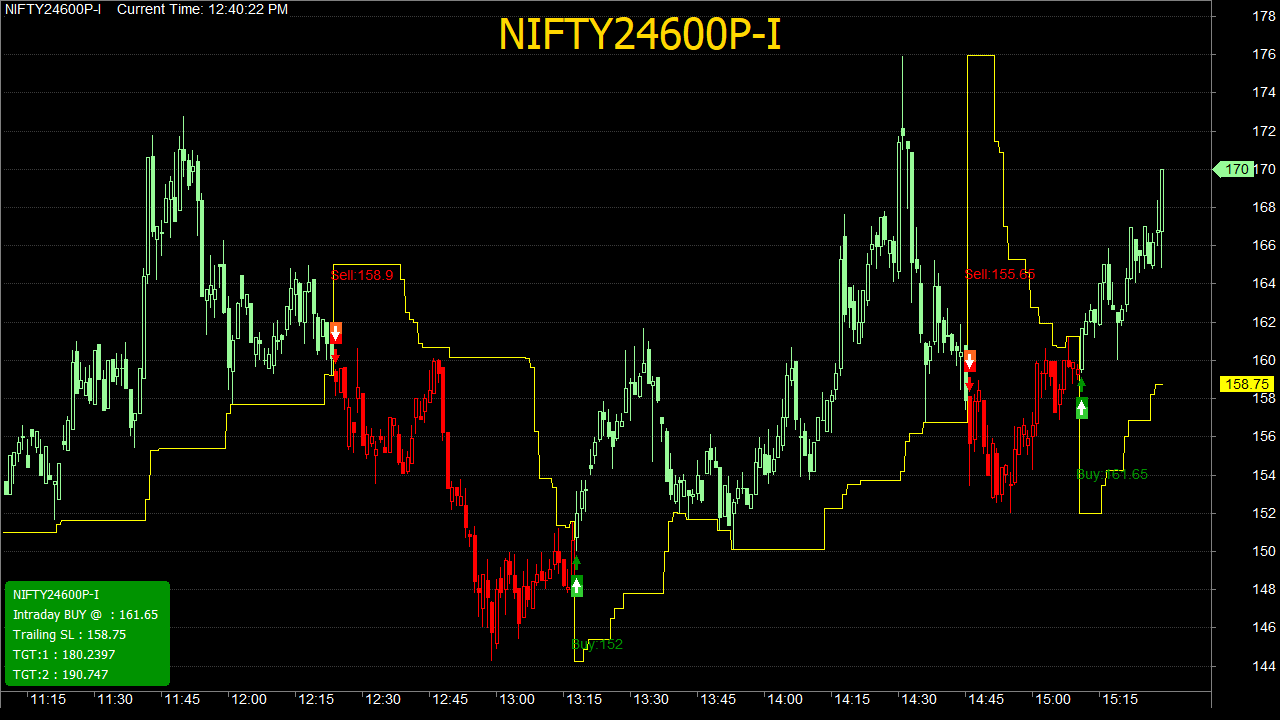

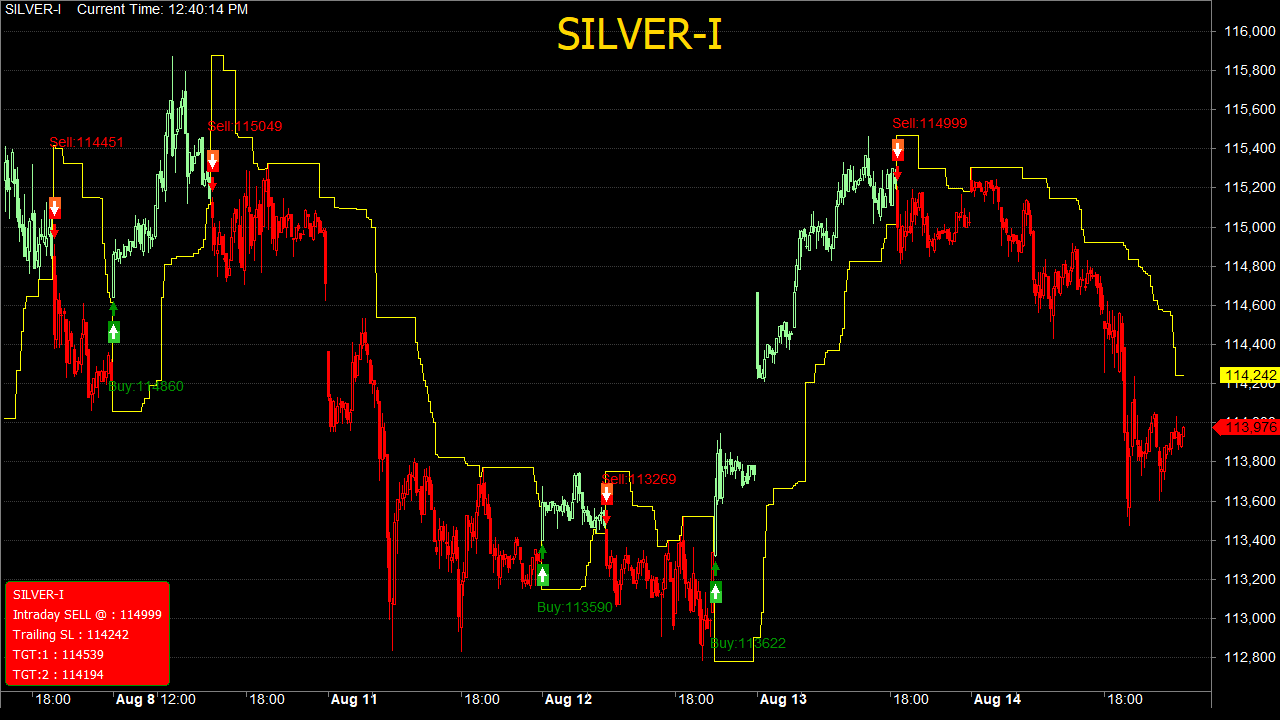

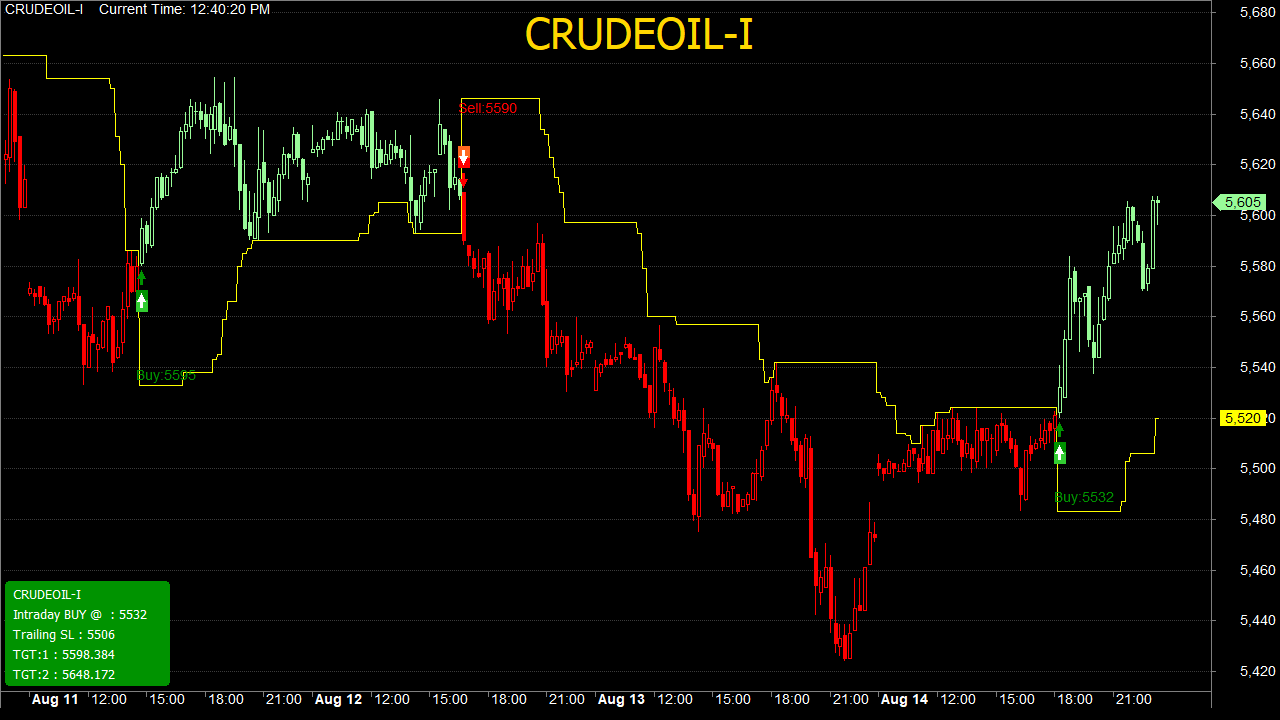

Our Trading Calls

Click to zoom

Simple & Accurate Buy Sell Calls!

No technical knowledge? No problem.

Our AI based smart system does all the analysis for you.

It gives you real-time buy/sell alerts, complete with targets and stop-loss.

Trade like a pro with accurate signals

No guesswork, just results.

14+

Years of Experience

80%+

Accuracy Rate

6k+

Active Users

98%

Client Satisfaction

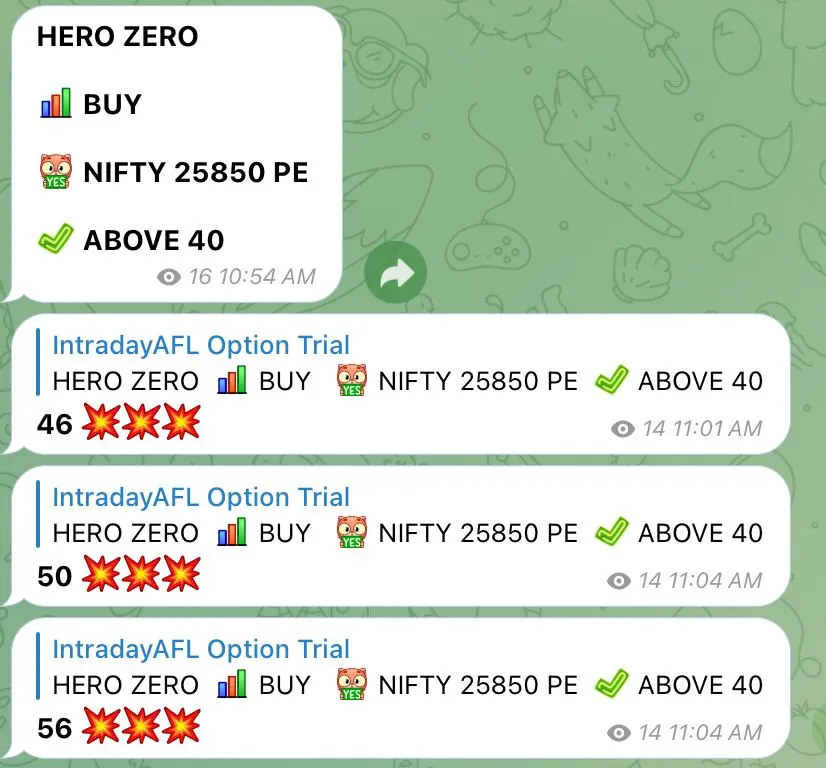

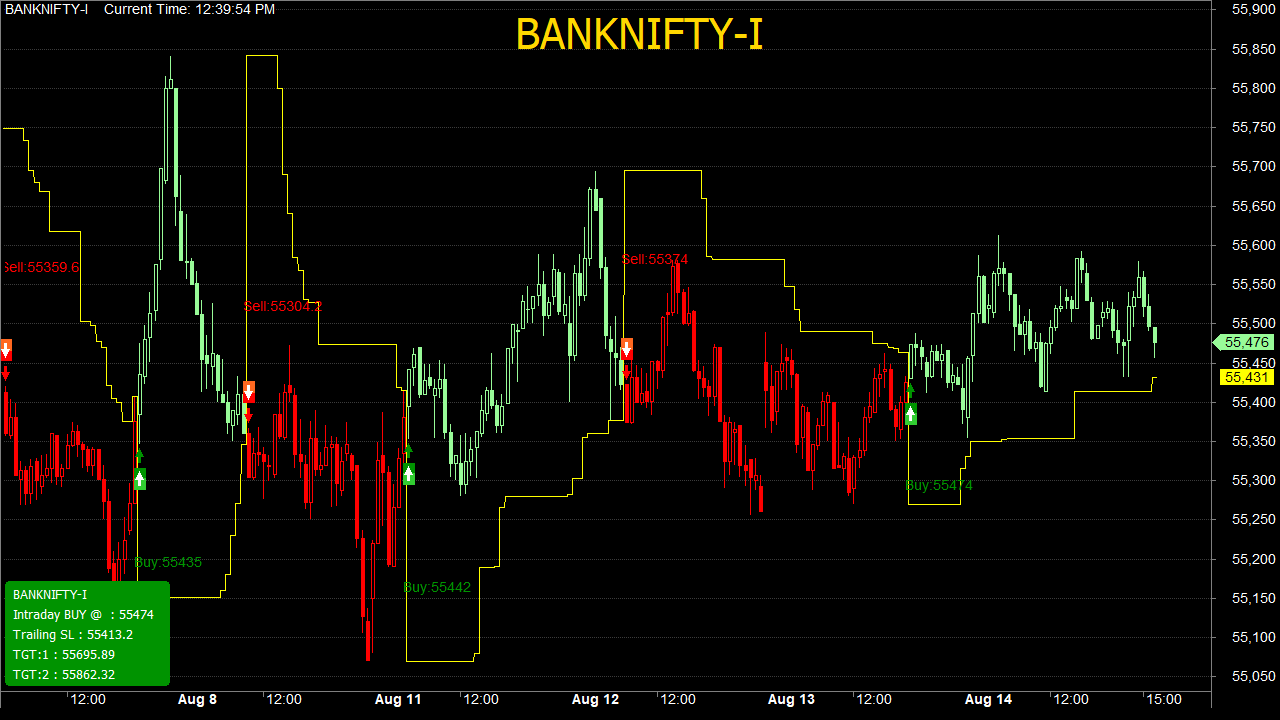

Our Charting System

Click to zoom

Our Services

Charting System (Windows OS)

The IntradayAFL Charting System will be installed and activated on your PC or laptop. The system will analyse and generate buy sell signals on any stock listed on the Indian stock market, including NSE Equity, Futures, Index Futures & Options, Commodity. You can select the stock of your choice to watch live buy sell charts and take trades accordingly.

Telegram Package

Receive trading calls directly on your mobile. Same Buy/Sell signals shown in the charting system delivered instantly via Telegram. These alerts come directly from our charts, running on servers, ensuring zero delay. Every morning our analysts select the best stocks, futures, options and commodities to get analysed by our system. Perfect for trading on the go.

Pricing Plans

Choose the plan that fits your trading needs

Hero Zero Option Calls

- 2-5X Return

- Index & Equity Option

- Average 2-5X Profit Per Call

- Special Calls on Exipry Days

- Clear Buy Price, Targets & Stop Loss

Charting system

- One Time Payment

- Remote Installation Support

- Step by Step Video Tutorial

- Accurate Charts of All Markets

- Live Data of Rs 499/Month Extra

Intraday Trading Calls

- 2-5X Return

- Private Telegram Channel

- Equity/Future/Options/Commodity

- Clear Buy Price, Targets & Stop Loss

- AI Generated Calls Directly From Charts

Client Testimonials

Hear what our satisfied clients say about our services

Anup Majhi

F&O Trader

"IntradayAFL's signals have transformed my trading results. The accuracy and detailed analysis have helped me achieve consistent profits month after month."

Ritesh

Commodity Trader

"The commodity analysis is exceptional. I've been using IntradayAFL for 3 years and it's the best investment I've made in my trading career."

Deepak Kumar

Investor

"The accuracy rate is truly impressive. IntradayAFL's insights have become an essential part of our investment decision-making process."

Frequently Asked Questions

Find answers to common questions about our services

Our signals have maintained an accuracy rate of over 80% since 2012. We achieve this through a combination of technical analysis, fundamental research, and proprietary algorithms. However, please remember that all trading involves risk, and past performance is not indicative of future results.

Intraday Trading Calls on Telegram starts from just 1999/month. And IntradayAFL Charting System is just Rs 4999 for Lifetime use. No renewal or subscription required. This charting system needs live data feed of markets to generate live buy sell charts. This live data costs only Rs 499 per month. You can subscribe live data for 1/3/12 months as per your requirements. We will help you in every step from installation to activation and all future live data feed recharge.

This service needs live data feed subscription from respective exchanges on activation to generate live buy sell charts. Which is not refundable as per exchange policy. So a demo activation of charting system on your PC or Laptop is not possible.

Our services are designed for traders of all experience levels. No technical knowledge? No problem. Our system does the hard work for you. It alerts you when to buy and sell, complete with targets and stop-loss levels.

We provide analysis and signals for major global stock markets, stocks, futures, options, commodities (gold, silver, oil, etc.) and indices. Our coverage includes Indian, US, European, and Asian markets during their respective trading hours.

Signals are generated in real-time through our charting system based on Amibroker. The Amibroker Formula Language built by our years of experience, analyses each and every movement in real time and generates signals to buy or sell. Each signal includes entry price, target levels, stop-loss.

This is a digital subscription product. If you are not satisfied with any one service, then we can offer you a change of service like charting system package to Telegram intraday call package during 1st 03 days of activation.

Get free market insights, trading tips, and exclusive offers delivered to you

Contact Us

Get in touch with our support team

- Email: support@intradayafl.com

- WhatsApp: +91-8448557996

- Telegram: @IntradayAFL_Owner