Skip to content

Market Summary (Previous Session – 09 June 2025):

- Open: 25,107.20

- High: 25,108.20

- Low: 25,099.40

- Close: 25,102.15

- Change: -4.40 (-0.02%)

- Volume: 8.09M (notably rising in the last hour)

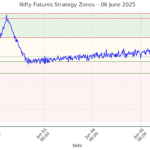

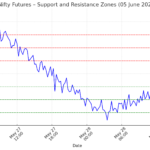

Chart Observations:

- Strong Support Zone:

- Around 25,080 – 25,100, visible from price bounces and consolidation.

- Immediate Resistance Zone:

- Near 25,130 – 25,150, where price rejected twice during mid-session.

- Volume Spike:

- Notable increase in volume near the close suggests potential breakout or reversal on 10th June.

- Trend Context:

- Market is range-bound with mild bearish bias.

- Slight upward consolidation in the second half of the session.

🧠 Trading Strategy for 10 June 2025 (Intraday – Scalping/Short-Term):

Bullish Scenario (Buy Setup):

- Entry Above: 25,120 with volume confirmation

- Target 1: 25,140

- Target 2: 25,160

- Stop Loss: Below 25,100

- Logic: Breakout of minor consolidation; momentum above 25,120 could trigger quick scalps.

Bearish Scenario (Sell Setup):

- Entry Below: 25,090 with strong bearish candle

- Target 1: 25,070

- Target 2: 25,050

- Stop Loss: Above 25,110

- Logic: Breakdown from support area may see continuation to lower supports.

Range Trading Plan (if market remains sideways):

- Buy near 25,080–25,090, Sell near 25,130–25,140

- Use tight stop loss of ~15 points and confirm with volume/price action.

⚠️ Caution Notes:

- Avoid early trades within the first 15 minutes unless volume is exceptionally high.

- Watch for global market cues, especially from US futures and SGX Nifty.

- Keep an eye on India VIX for volatility spikes.