Intraday trading requires quick decision-making and precise analysis. Technical indicators are essential tools that help traders understand market trends, identify potential entry and exit points, and make informed trading decisions. Here are the top five technical indicators that every intraday trader should know:

1. Moving Averages (MA)

What It Is:

- Moving Averages (MA) smooth out price data to identify the direction of the trend over a specific period. The two most commonly used moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Why It’s Important:

- Moving Averages help traders determine the overall trend direction, which is crucial for intraday trading. They can also identify potential support and resistance levels.

How to Use:

- Crossover Strategy: A common strategy is to use two moving averages of different periods. When the shorter period MA crosses above the longer period MA, it generates a buy signal, and when it crosses below, it generates a sell signal.

- Example: A 5-period EMA crossing above a 20-period EMA could indicate a bullish trend.

2. Relative Strength Index (RSI)

What It Is:

- The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements on a scale of 0 to 100. It is used to identify overbought and oversold conditions in the market.

Why It’s Important:

- RSI helps traders identify potential reversal points by signaling when an asset is overbought (typically above 70) or oversold (typically below 30).

How to Use:

- Overbought/Oversold Strategy: When RSI crosses above 70, the asset may be overbought, suggesting a potential sell opportunity. Conversely, when RSI falls below 30, the asset may be oversold, indicating a potential buy opportunity.

- Example: If the RSI drops below 30 and then rises above it, it could be a signal to buy.

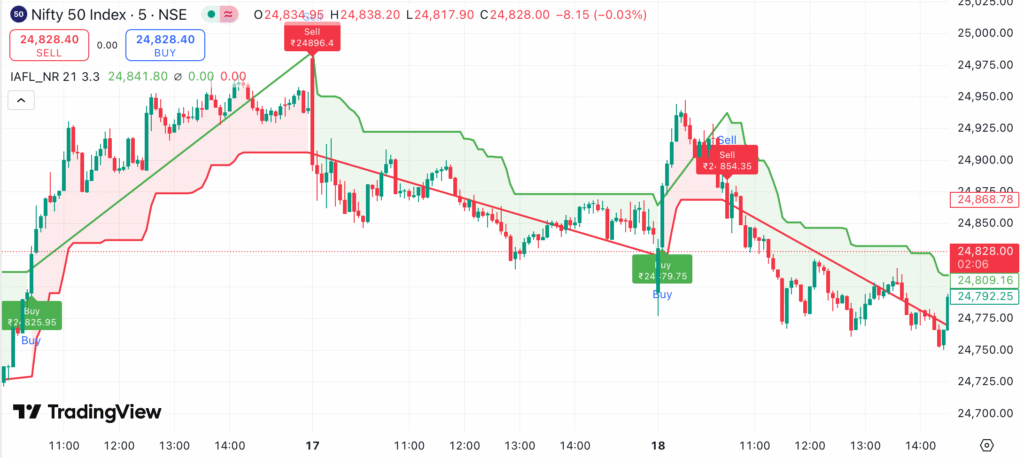

3. Bollinger Bands

What It Is:

- Bollinger Bands consist of a middle band (a simple moving average) and two outer bands that represent standard deviations of the price. They expand and contract based on market volatility.

Why It’s Important:

- Bollinger Bands help traders understand the volatility of the market. When the bands are narrow, it indicates low volatility, and when they widen, it suggests increased volatility.

How to Use:

- Bollinger Bounce: Price tends to return to the middle band after touching the upper or lower bands, making these bands potential support and resistance levels.

- Example: If the price touches the lower band and then starts to move upward, it could signal a buying opportunity.

4. Moving Average Convergence Divergence (MACD)

What It Is:

- The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, the signal line, and the histogram.

Why It’s Important:

- MACD helps traders identify changes in the strength, direction, momentum, and duration of a trend.

How to Use:

- MACD Crossover: When the MACD line crosses above the signal line, it generates a bullish signal. Conversely, when it crosses below, it generates a bearish signal.

- Example: A MACD line crossing above the signal line while both are below the zero line may indicate the beginning of an upward trend.

5. Volume

What It Is:

- Volume measures the number of shares or contracts traded in a security or market during a given period. It is one of the most basic yet powerful indicators of market activity and sentiment.

Why It’s Important:

- High volume indicates strong investor interest and can confirm the strength of a price move, whether it’s a breakout or a trend continuation.

How to Use:

- Volume Spike: A sudden increase in volume often precedes significant price movements. A price breakout accompanied by high volume is more likely to be sustainable.

- Example: If a stock breaks above a resistance level with high volume, it’s more likely to continue rising.

Conclusion

These five technical indicators are essential tools for intraday traders. Each one provides unique insights into market conditions, helping traders make better-informed decisions. By combining these indicators, traders can develop a comprehensive trading strategy that increases the likelihood of success in the fast-paced world of intraday trading.