Amibroker is a comprehensive charting and analysis software designed for traders who want to build custom trading systems. It allows users to perform detailed technical analysis, develop and test trading strategies, and automate trading processes. With its wide range of features, Amibroker is suitable for trading stocks, commodities, forex, cryptocurrencies, and other financial instruments.

2. Setting Up Amibroker

2.1. Installation

- Download: Visit the official Amibroker website to download the latest version of the software.

- Install: Follow the installation instructions, and choose the default options unless you have specific preferences.

- Licensing: Amibroker offers different licensing options, including a free trial. Choose the plan that best suits your needs.

2.2. Data Feeds

Amibroker requires data feeds to display price charts and perform analysis. You can either use free data sources or subscribe to premium data providers.

- Free Data: Yahoo Finance, Google Finance (may require additional plugins).

- Paid Data: Interactive Brokers, eSignal, MetaStock, GlobalDataFeeds.

Ensure that your chosen data feed is compatible with Amibroker.

3. Navigating the Amibroker Interface

3.1. Workspace Layout

- Charts: The main window where you can view different types of charts (e.g., candlestick, bar, line).

- Analysis Window: Used for backtesting, optimization, and running explorations.

- AFL Editor: The place to write and edit Amibroker Formula Language (AFL) code.

3.2. Customizing Layout

You can customize the workspace by arranging the windows to suit your workflow. Right-click on any window or toolbar to add or remove tools as needed.

4. Understanding Amibroker Formula Language (AFL)

AFL is the scripting language used in Amibroker to create custom indicators, backtest strategies, and generate trading signals.

4.1 Basics of AFL

- Syntax: AFL uses a C-like syntax, making it relatively easy to learn if you have programming experience.

- Variables: Store data such as prices, moving averages, and other indicators.

- Functions: Predefined functions in AFL allow you to calculate indicators, execute trades, and perform other operations.

5. Creating and Backtesting Trading Strategies

5.1. Developing a Strategy

To create a trading strategy, you’ll need to define the rules for entering and exiting trades. For example, a simple moving average crossover strategy might look like this:

- Buy Signal: When the short-term SMA crosses above the long-term SMA.

- Sell Signal: When the short-term SMA crosses below the long-term SMA.

5.2. Backtesting

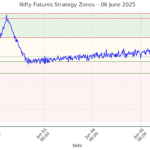

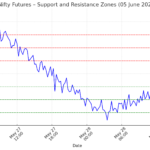

Backtesting allows you to test your strategy on historical data to see how it would have performed in the past.

- Steps:

- Open the Analysis window.

- Load your strategy in the AFL Editor.

- Select the time period and data range for testing.

- Run the backtest and review the results.

Backtesting will provide performance metrics such as the number of trades, win/loss ratio, profit/loss, and drawdown.

6. Optimizing Your Strategy

Optimization helps you fine-tune your trading strategy by testing different parameter values (e.g., SMA periods) to find the most profitable settings.

- Steps:

- Define the range of parameters to optimize.

- Run the optimization in the Analysis window.

- Review the optimized results and choose the best-performing parameters.

7. Automating Trading Strategies

Once you’ve developed and tested a strategy, you can automate it to execute trades based on your predefined rules.

- Broker Integration: Amibroker supports integration with brokers like Interactive Brokers for automated trading.

- API and Plugins: Use APIs or third-party plugins to connect Amibroker with your brokerage account for seamless trade execution.

8. Common Challenges and Troubleshooting

8.1. Data Issues

Ensure that your data feeds are correctly configured and that the data is up to date. Inconsistent or outdated data can lead to inaccurate analysis and backtesting results.

8.2. AFL Errors

If you encounter errors in your AFL code, use the debugger tool in the AFL Editor to identify and fix issues.

8.3. Strategy Performance

If your strategy is underperforming, consider revisiting your trading rules, optimizing parameters, or adjusting for current market conditions.

9. Additional Resources and Learning

- Amibroker User Manual: The official manual provides comprehensive information on all features and functions.

- Online Forums and Communities: Join forums like Traderji, Elite Trader, or Amibroker’s official forum to connect with other traders.

- YouTube Tutorials: There are numerous video tutorials available for visual learners.

- Books and Courses: Consider investing in books or online courses focused on technical analysis and Amibroker.

10. Conclusion

Amibroker is a versatile tool that can significantly enhance your trading process by allowing you to develop, test, and automate trading strategies. As a beginner, start by familiarizing yourself with the software’s interface, learning AFL, and experimenting with simple strategies. With practice and continuous learning, you’ll be able to leverage Amibroker’s full potential to achieve your trading goals.