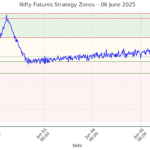

Based on the 15-minute candlestick chart of NIFTY Futures ending on 5 June 2025, here’s a technical outlook:

📉 Nifty Futures Technical Outlook – 5 June 2025

Key Observations:

- Price Level: 24,612

- Recent Range: Price has been oscillating between 24,450 and 24,750 since May 30.

- Structure: A base seems to be forming around 24,550–24,580, showing consolidation.

- Volatility: Intraday volatility has decreased, especially after the dip on June 3.

- Trend Bias: Near-term bias appears neutral to mildly bullish due to:

- Higher lows from June 4.

- Sideways to slightly upward bias visible toward June 5 morning.

Support Levels:

- 24,550 – Minor intraday support.

- 24,500–24,480 – Stronger support zone based on bounce activity.

- 24,450 – Critical support; breakdown here could invite a sharp fall.

Resistance Levels:

- 24,650–24,670 – Immediate hurdle (tested multiple times).

- 24,700–24,750 – Previous swing highs.

- 24,800+ – Bullish continuation zone.

🔮 Intraday Outlook (5 June 2025):

| Direction | Bias | Entry Area | Target 1 | Target 2 | SL |

|---|---|---|---|---|---|

| Buy | Cautious Bullish | 24,580–24,600 | 24,650 | 24,700 | 24,540 |

| Sell | Only below 24,540 | 24,520–24,540 | 24,470 | 24,420 | 24,580 |

Suggestion: Avoid aggressive positions until a breakout above 24,670 or breakdown below 24,540.

⚠️ Market Sentiment Note:

- The flat close and tight range suggest market participants are awaiting a major trigger or news (possibly policy-related or global cues).