Nifty & Bank Nifty Post-Market Analysis 04/08/25 | Trading Strategy for 05/08/25

Key Takeaways

- Nifty 50 closed at 24,726.90, recovering from intraday lows.

- Bank Nifty settled at 55,643.95 after sideways consolidation.

- Global cues remain mixed; US markets are range-bound.

- Volatility cooled off, hinting at potential directional move ahead.

Price Action Breakdown (Nifty and Bank Nifty)

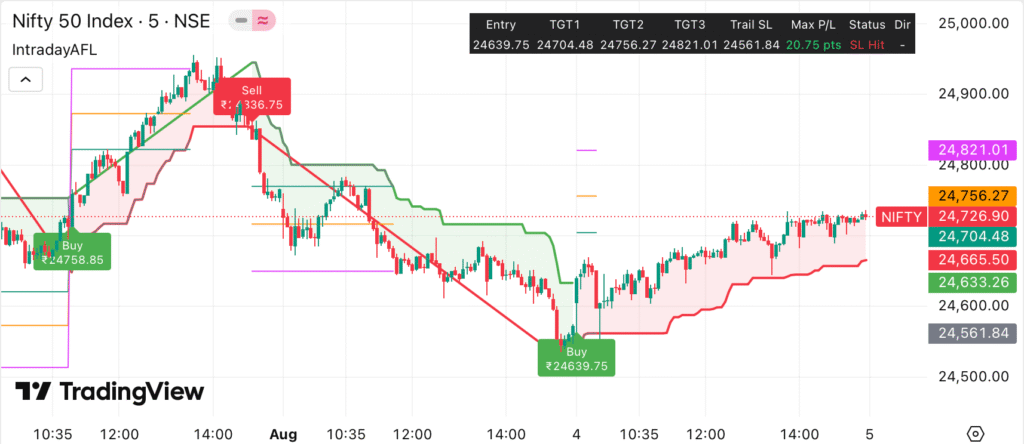

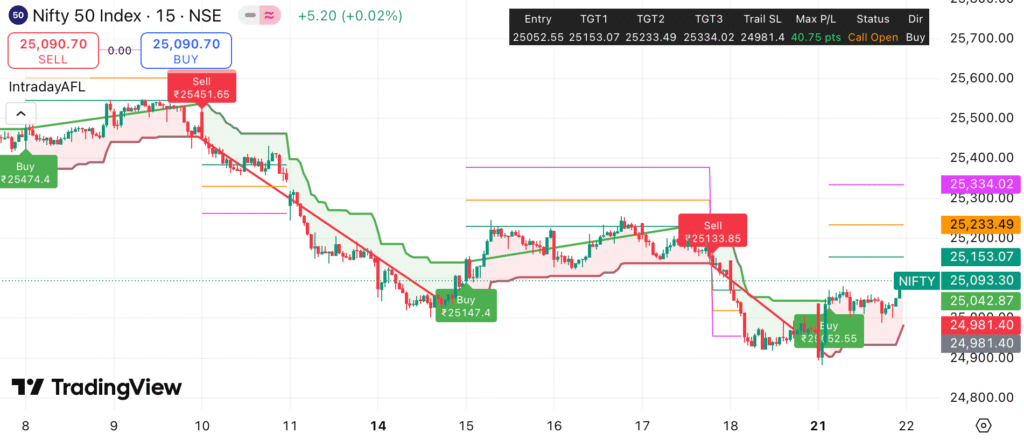

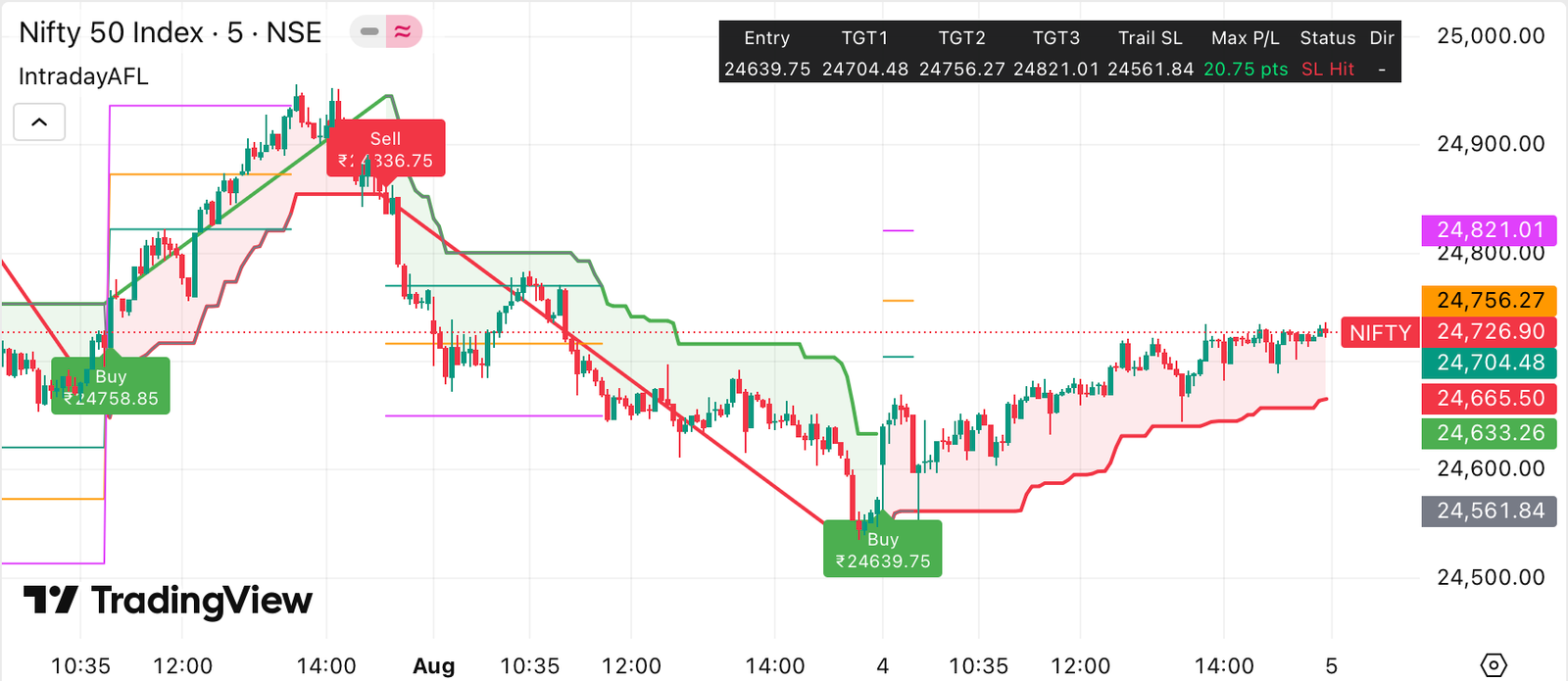

On 04th August 2025, Nifty 50 opened flat but faced early selling pressure. The index found support near 24,520 and staged a slow recovery. However, upside remained capped near 24,740. A gradual grind higher in the second half helped Nifty close near the day’s high at 24,726.90. This indicates buyers are defending lower levels aggressively.

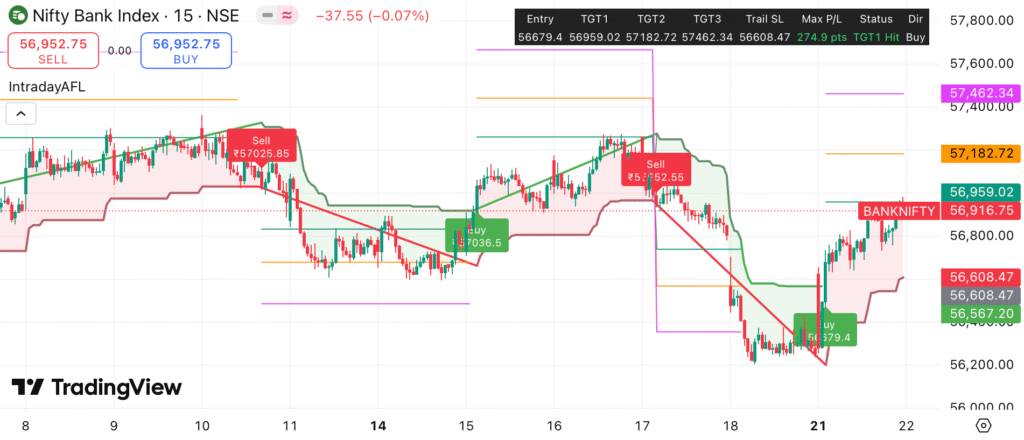

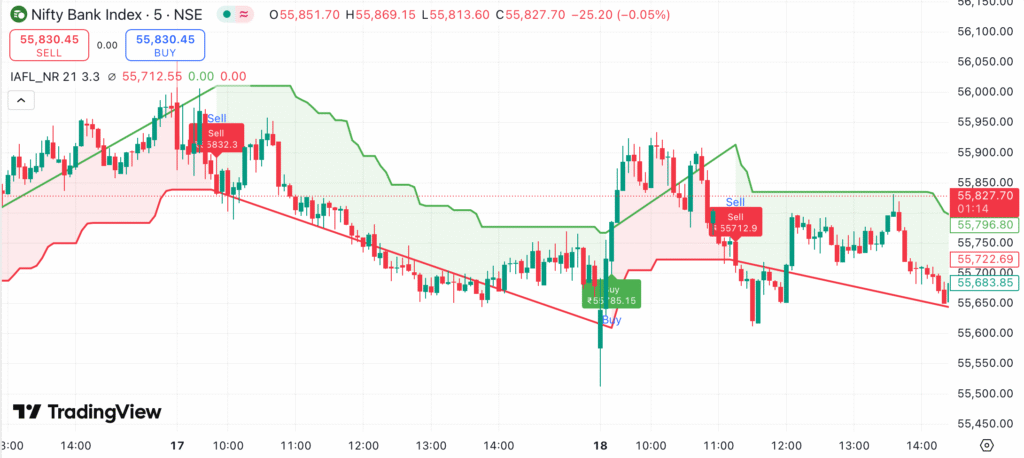

Bank Nifty followed a similar trajectory. The index slipped to intraday lows of 55,400 but managed a pullback towards 55,700 levels. However, price action turned range-bound post 1 PM, resulting in a narrow consolidation phase. Bank Nifty closed the day at 55,643.95, forming a base for the next move.

You can track live Buy-Sell signals using our Free Live Buy-Sell Chart.

Global Market and Macro Updates

- Asian markets ended mixed; Nikkei gained 0.5%, while Hang Seng dropped 0.8%.

- US Futures traded flat ahead of crucial jobs data release.

- Crude Oil prices stabilized near $83 per barrel (Source: Investing.com).

- Indian Rupee remained steady at 83.12/USD amid dollar weakness.

Technical Indicator Table

| Indicator | Nifty 50 | Bank Nifty |

|---|---|---|

| RSI (14) | 54 (Neutral) | 49 (Neutral) |

| India VIX | 11.85 (Low Volatility) | |

| Put Call Ratio (PCR) | 1.12 (Bullish Bias) | |

Sector Performance Table

| Sector | Performance |

|---|---|

| IT | +0.45% |

| Auto | +0.30% |

| FMCG | -0.20% |

| Banking | Flat |

Trading Strategy for 05/08/25 (Intraday + Swing)

Nifty 50 Strategy

If Nifty sustains above 24,750, expect a rally towards 24,850-24,900 zones. However, a break below 24,660 will invite selling pressure. Swing traders should maintain a bullish bias as long as Nifty holds 24,600.

Bank Nifty Strategy

Bank Nifty needs to break 55,750 for fresh upside. Immediate targets are 55,900 and 56,050. On the downside, 55,500 remains a key support. Swing traders can initiate long positions near 55,500 with a stop loss of 55,350.

For precision entries, use our IntradayAFL TradingView Indicator.

Key Levels Table

| Index | Support Levels | Resistance Levels |

|---|---|---|

| Nifty 50 | 24,660 / 24,600 | 24,750 / 24,900 |

| Bank Nifty | 55,500 / 55,350 | 55,750 / 56,050 |

Final Thoughts

Markets are poised for a directional move after recent consolidation. Low volatility suggests a breakout is near. Traders should closely watch global cues and domestic news flow. Risk management is key. Always trade with proper stop-losses and position sizing.

Disclaimer

This article is for informational purposes only. It does not constitute investment advice. Readers are advised to consult their financial advisor before making any trading decisions. The author and website are not responsible for any financial losses incurred.